5 Key Things You Should Know BEFORE Buying Your First Home

Buying your first home is a monumental milestone, one that is often filled with excitement, anticipation, and perhaps a little bit of anxiety. However, if you’re not equipped with the right information and guidance, the journey can quickly turn overwhelming. In this article, we’ll explore the 5 Things You Must Know to Buy Your First Home in the beautiful Denver Metro area of Colorado. Whether you're drawn to the breathtaking Rocky Mountains, the vibrant city life, or the serene suburban neighborhoods, understanding the home-buying process is crucial for making informed decisions.

Table of Contents

- Introduction to Top 5 Things You Must Know to Buy Your First Home

- Talk To A Real Estate Agent

- Get Pre-Approved By A Lender

- Define Your Home And Lifestyle Needs

- Contracts And Showing

- Making The Offer

- What Is Earnest Money?

- Comparative Market Analysis

- Closing Cost

- Conclusion

- FAQ

Introduction to Top 5 Things You Must Know to Buy Your First Home

As a seasoned real estate professional with over 17 years of experience, I have witnessed countless first-time homebuyers navigate the complexities of the market. This article aims to distill the key insights from my experiences into actionable tips that will help you along your journey to homeownership. Let’s dive in!

Talk To A Real Estate Agent

The very first step in your home-buying journey is to talk to a real estate agent. This is not just a suggestion; it’s a crucial part of the process. An experienced agent can help you navigate the many intricacies involved in buying a home.

Here are a few reasons why engaging with a real estate agent is essential:

- Expert Guidance: A good agent will help you understand your options and guide you through the entire buying process.

- Local Knowledge: Agents have in-depth knowledge of neighborhoods, market trends, and property values, which can save you time and money.

- Professional Negotiation: An experienced agent will negotiate on your behalf, ensuring you get the best deal possible.

It's important to establish a personal connection with your agent. I recommend having a brief conversation to discuss your desires, why you're looking to move, and what you hope to achieve in your new home. This connection will allow your agent to tailor their services to your unique needs.

Get Pre-Approved By A Lender

The second most important step in the home-buying process is to get pre-approved by a mortgage lender. A pre-approval is not just a formality; it is a critical step that tells you how much you can afford and strengthens your position when making an offer.

Here’s why getting pre-approved is so important:

- Financial Clarity: You’ll know your budget, which helps narrow down your home search to properties within your financial reach.

- Competitive Edge: Sellers are more likely to consider offers from buyers who have been pre-approved, as it shows you are serious and financially capable.

- Understanding Loan Options: A good mortgage lender will explain the different types of loans available and help you select the best option for your financial situation.

When choosing a lender, you have several options:

- Traditional Banks: While they may have higher interest rates, they are a reliable choice.

- Mortgage Lenders: Often more flexible than banks, these lenders can offer better rates and personalized service.

- Mortgage Brokers: They work with multiple banks and can help you find the best deal, but may be a bit less hands-on.

Define Your Home And Lifestyle Needs

Once you have your financials in order, the next step is to define your home and lifestyle needs. This is where you can really start to envision your future in a new home.

Consider the following factors when defining your needs:

- Location: Think about where you want to live. Proximity to work, schools, and amenities can greatly affect your quality of life.

- Size and Layout: How many bedrooms and bathrooms do you need? Do you prefer an open floor plan or more traditional layouts?

- Community Features: Consider whether you want to live in a neighborhood with parks, community centers, or other amenities.

During this phase, it’s essential to communicate openly with your real estate agent. They will help you identify properties that match your criteria and set up viewings.

Contracts And Showing

The next step in your journey is to familiarize yourself with contracts and showing processes. Once you’ve identified homes that pique your interest, it’s time to take a closer look.

Here’s what to expect:

- Exclusive Right to Buy Agreement: In Colorado, you’ll typically sign a contract that names your agent as your representative. This agreement is vital for ensuring your agent can negotiate on your behalf.

- Home Showings: Your agent will arrange showings for homes that meet your criteria. This part of the process is often one of the most enjoyable, as you get to envision your life in various settings.

Make sure to ask your agent any questions during this phase, and don’t hesitate to voice any concerns. Open communication is key!

Making The Offer

After you’ve found the home that feels just right, it’s time to make an offer. This is an exciting moment, but it’s also a critical step that requires careful consideration.

Here’s how to make a compelling offer:

- Determine Your Offer Price: Work with your agent to assess the fair market value of the home using a Comparable Market Analysis (CMA).

- Earnest Money: This is a deposit that shows the seller you are serious. Typically, earnest money is about 1% of the home’s price.

- Contingencies: Define any conditions that must be met for the sale to proceed, such as inspections or financing.

Once your offer is submitted, the seller may accept, counter, or decline it. Your agent will help you navigate this negotiation process to ensure you get the best deal possible.

What Is Earnest Money?

Earnest money is a crucial aspect of the home-buying process. It serves as a deposit that demonstrates your commitment to purchasing the property.

Key points to remember about earnest money:

- Amount: Typically, this is around 1% of the purchase price, but it can vary based on the market and the property.

- Refundable: If the deal falls through due to contingencies, you may get your earnest money back.

- Non-refundable: If you back out of the deal without a valid reason, the seller may keep your earnest money.

Comparative Market Analysis

A Comparative Market Analysis (CMA) is a vital tool that helps you understand the value of the home you’re interested in. This analysis compares the target property to similar homes that have recently sold in the area.

Here’s why a CMA is important:

- Informed Offers: A CMA will help you determine a fair offer price, so you don’t overpay.

- Market Trends: Understanding recent sales will give you insights into market conditions and help you strategize your offer.

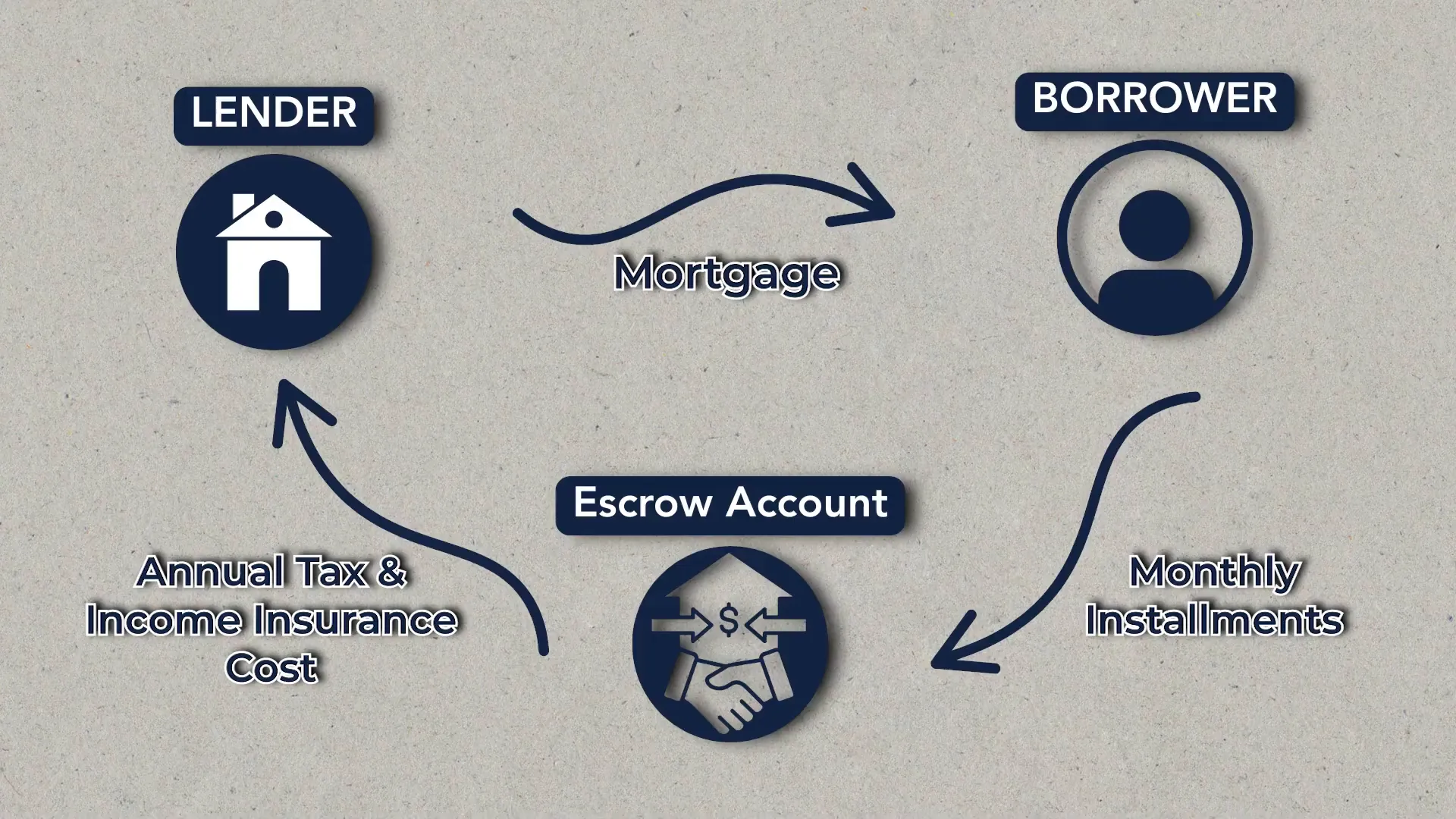

Closing Cost

Closing costs are another important aspect of the home-buying process that you need to be aware of. These costs can add up, so it’s crucial to understand what they entail.

Some common closing costs include:

- Loan Fees: This can include processing and underwriting fees.

- Escrow Costs: Part of your monthly mortgage payment may go into an escrow account for property taxes and insurance.

- Title Insurance: This protects against any legal claims on the property.

Typically, closing costs can range from 1% to 1.5% of the home’s purchase price. It’s wise to budget for these expenses to avoid any surprises.

Conclusion

In conclusion, buying your first home in the Denver Metro area is an exciting journey filled with opportunities. By understanding these 5 Things You Must Know to Buy Your First Home, you can navigate the process with confidence and ease.

Whether you’re enjoying the views of the Rocky Mountains or exploring the vibrant neighborhoods of Denver, remember that having the right guidance is crucial. If you're interested in more information or need personalized support, feel free to reach out. I’m here to help you every step of the way!

Thank you for reading, and best of luck on your journey to homeownership!

EXPLORE AVAILABLE HOMES IN THE DENVER METRO AREA

FAQ

How do I find a good real estate agent?

Look for agents with local expertise, positive reviews, and a proven track record in helping first-time buyers.

What are the common mistakes first-time homebuyers make?

Some common mistakes include not getting pre-approved, skipping the home inspection, and not understanding the full cost of homeownership.

How long does the home-buying process take?

The process can take anywhere from a few weeks to several months, depending on your circumstances and the market conditions.

What should I look for during a home tour?

Pay attention to the condition of the property, layout, and any potential issues that may require repairs.

Can I back out of an offer?

Yes, but it depends on the terms of your contract and any contingencies that were included in your offer.

L. Clinton Porter

Clinton stands as a leading real estate expert in the Denver Metro Area, backed by 17 years of experience and a proven track record of success.

Specializing in everything from luxury estates to studio condos, Clinton, with Real Broker LLC, has established a reputation for integrity, excellence, and an unyielding commitment to client satisfaction.